Understanding your roof damage estimate after a storm can be overwhelming. Terms like ACV, RCV, and depreciation appear throughout the paperwork, and the numbers don’t always seem to make sense. Many Illinois and Iowa homeowners are left wondering whether their insurance claim truly covers the cost of a quality roof replacement.

This guide breaks down how to interpret and verify your roof damage estimate so you can move forward with confidence, make informed decisions, and avoid costly surprises.

Why Insurance Estimates Are Confusing

Insurance companies aren’t exactly known for making things easy. Their reports use complex terms, multiple payment stages, and standardized pricing that often differs from what local roofing contractors charge.

Here are a few reasons homeowners get confused when trying to understand insurance estimates:

- Different Terminology: Insurance uses “scope of work” and “depreciation,” while roofers talk about tear-off, underlayment, or flashing.

- Multiple Numbers for the Same Job: Your paperwork might list an “ACV payment,” a “deductible,” and a “recoverable depreciation.”

- Regional Pricing Gaps: Insurance relies on national software such as Xactimate, which doesn’t always match Illinois or Iowa labor rates.

If your home was hit by hail or high winds, our storm damage repair team explains what to do first. Knowing how these parts fit together helps you see what’s covered and what might be missing.

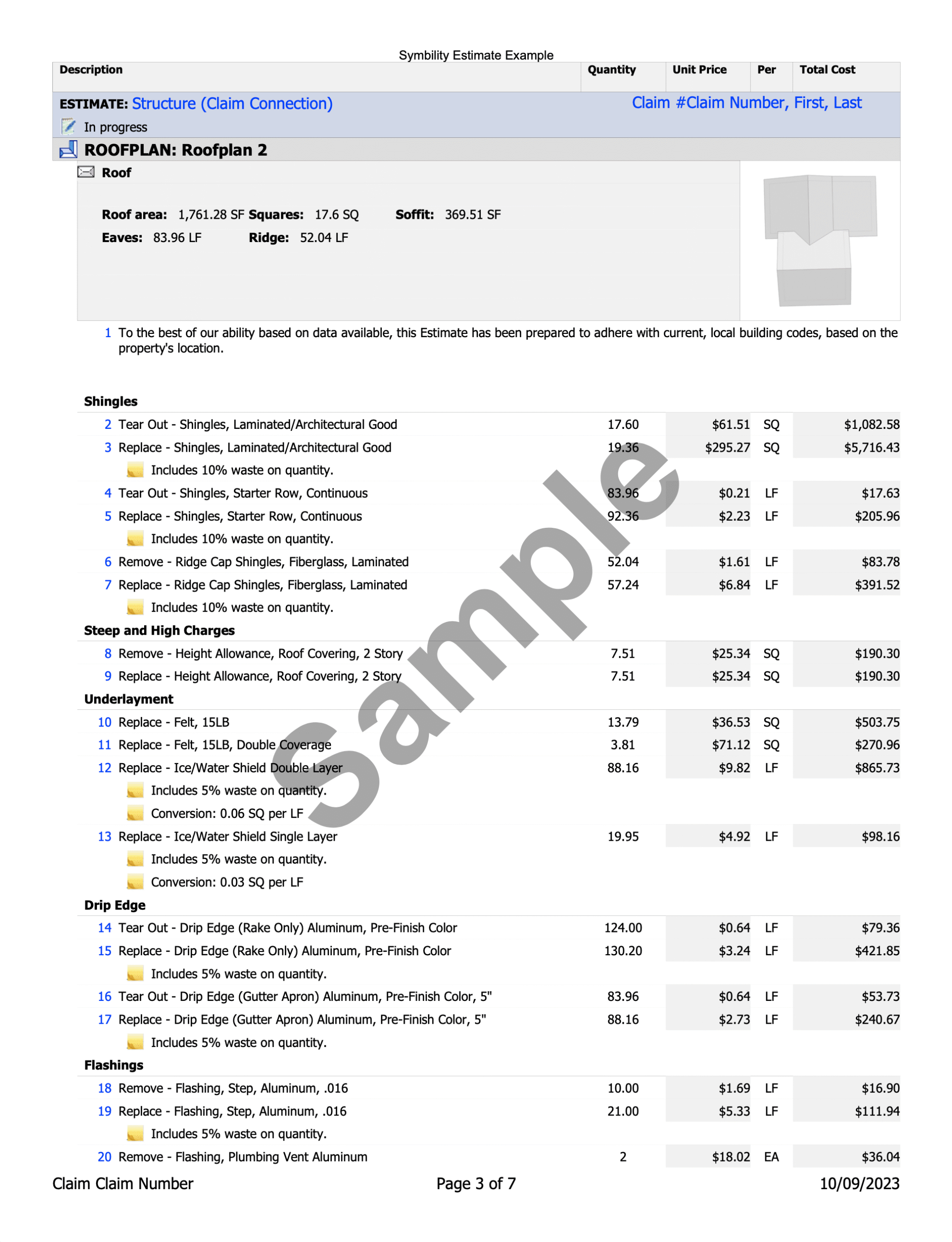

The first section includes your basic information — your name, address, claim number, and the location of the damage. Below that, you’ll find the line items, which list every repair, material, and cost related to your roof project.

Key Terms You’ll See in Your Insurance Estimate

Before you dive into the numbers, get familiar with these essential definitions:

- Description: Lists the specific repairs and materials needed. For example, tearing off old shingles, re-nailing roof decking, or replacing flashing.

- Quantity: Shows how much of each item is required based on your roof’s size and damage (measured in squares, feet, or pieces).

- Unit Cost: The price per individual unit. For example, per shingle bundle or foot of flashing.

- ACV (Actual Cash Value): The current value of your roof after age and wear are factored in.

- RCV (Replacement Cost Value): What it costs to replace your roof with new materials at today’s prices.

- Depreciation: The value your roof has lost over time. Often reimbursed once the project is complete.

- Deductible: The portion you’re responsible for. Contractors can’t legally waive or cover this.

- Scope of Work: A detailed breakdown of what your insurance company approved for labor, materials, and repairs.

At the end of the estimate, you’ll also see summary sections that total everything up:

- Line Item Total: The combined cost of all listed repairs.

- Sales Tax: State sales tax on materials.

- Overhead & Profit: Standard contractor costs for managing and completing the project.

- Replacement Cost Value (RCV): The final approved total before your deductible.

- Net Claim: The amount your insurance company will pay after subtracting your deductible.

If your home has additional damage (like in the attic or ceilings), those items will appear as separate line sections for each area.

Sometimes, the roofer’s detailed estimate may differ slightly from the insurance company’s version due to pricing databases or missed items. When that happens, your roofing contractor can document and submit those differences to help align both estimates before work begins.

Download/View Full 7 Page PDF Example

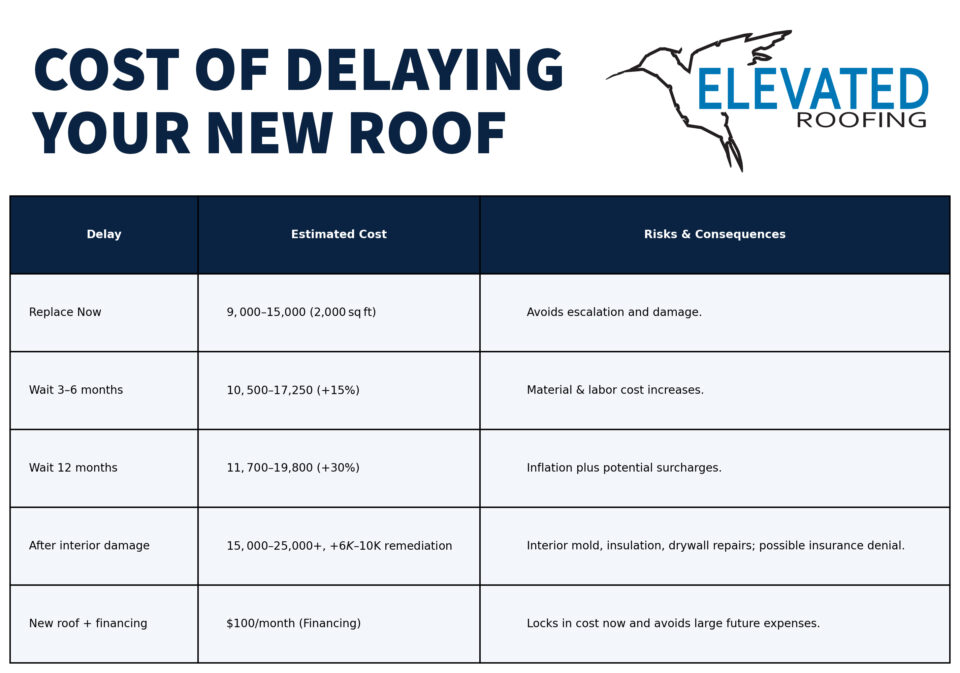

How the Numbers Usually Add Up

Here’s a simple example of how most insurance estimates are structured:

- Replacement Cost Value (RCV): $18,000 → total approved cost of the roof

- Depreciation: $6,000 → temporarily withheld by insurance

- Actual Cash Value (ACV): $12,000 → first check issued

- Deductible: $1,500 → homeowner’s out-of-pocket responsibility

- Recoverable Depreciation: $6,000 → released after completion and proof of work

Roof Damage Insurance Payout Formula

RCV – Depreciation = ACV

ACV – Deductible = First Payment

First Payment + Recoverable Depreciation = Total Insurance Payout

Example Math Equation:

$18,000 (RCV) – $6,000 (Depreciation) = $12,000 (ACV)

$12,000 (ACV) – $1,500 (Deductible) = $10,500 (First Payment to Homeowner)

$10,500 (First Payment to Homeowner) + $6,000 (Recoverable Depreciation) = $16,500 Total Paid by Insurance

Homeowner Out-of-Pocket = $1,500 Deductible

In this case, the homeowner receives $10,500 upfront and $6,000 later, after proof of completion. Leaving only the $1,500 deductible out-of-pocket.

After a late-spring hailstorm in Galena, one homeowner discovered their estimate left out new ridge vent installation — a $1,200 oversight they caught early thanks to a detailed contractor review.

Pro Tip for Homeowners

Always keep copies of all estimate pages and payment checks. Your contractor will need these to match the approved scope and ensure nothing is missed during the build.

Top 5 Questions About Roof Damage Insurance Estimates

1. Why doesn’t the first check cover the full amount?

Insurance holds back depreciation until the project is completed and documented. This ensures the funds go toward your approved repairs.

2. What if my roofer’s estimate is higher than my insurance estimate?

That’s common. Insurance software doesn’t always reflect real local pricing. A licensed contractor can document the difference to support a supplemental review.

3. Will filing a storm damage claim raise my rates?

Storm claims are considered “acts of God.” They typically don’t impact your personal premium, though rates can rise regionally after major events.

4. What if the insurance company missed part of the damage?

Additional items can be submitted later if documented properly. Our guide on signs your roof needs attention shows what to check before the next storm.

5. Can a contractor pay my deductible?

No. It’s illegal in Illinois and Iowa for any contractor to cover or rebate your deductible. Always verify this in writing.

For an additional perspective, the National Roofing Contractors Association outlines homeowner rights and responsibilities when reviewing insurance-based estimates.

How Elevated Roofing Helps You Navigate the Process

We know how stressful storm recovery can be. Our team focuses on helping you feel confident through every step of your roof replacement or repair.

Here’s what we do:

- Detailed Roof Evaluations: Comprehensive inspections with photo evidence to support your documentation.

- Clear Documentation: Reports are formatted for insurance use, making communication easier.

- Emergency Protection: Temporary tarping to prevent further damage while your claim is processed.

- Trusted Local Expertise: Certified CertainTeed Select ShingleMaster installers serving Illinois, Iowa, and Wisconsin.

We don’t negotiate with insurance companies or speak on your behalf, but we do provide accurate information and everything you need to keep your project moving.

Take the Guesswork Out of Your Roof Damage Estimate

Understanding your insurance estimate doesn’t have to be overwhelming. When you know the terms, verify the math, and partner with a trusted local roofing company, you can be sure your roof is repaired or replaced correctly — without unexpected costs.

Have a recent estimate and are not sure what it covers? Contact Elevated Roofing today. We’ll walk you through the details, show you what’s included, and help you plan your next step before the next storm rolls in.